Enjoy the benefits of the PowerFlex

Free ATM fees

Access our partner convenience stores' ATMs 24/7 for free.*1

Internet Banking

Access your account whenever and wherever you want.*2

Bilingual Service

English Internet banking and customer support available via Chat/Webform and Contact Center.

Free Domestic

online

transfer

At least one free domestic online transfer per month.*3

- ATM operating hours may differ depending on business hours of the building in which the ATM is installed and system maintenance of SBI Shinsei Bank or partners.

- Due to system maintenance, there are times when this service is unavailable.

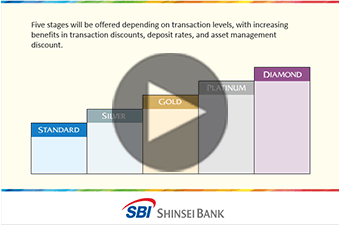

- More details about the Preferencial services, Step Up Program

What's new

- December 5, 2023

- Removal of the Restriction on PowerDirect Transactions of the Customers Who Left Japan

- October 2, 2023

- Termination of GAICA Flex Prepaid Card Service

- August 15, 2023

- 【Updated August 15】Termination of the Issuance of Security Code Cards and Addition of New Authentication

- August 10, 2023

- Notice of Termination of Security Code Cards Authentication

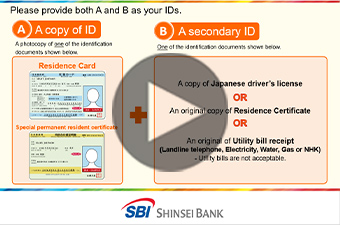

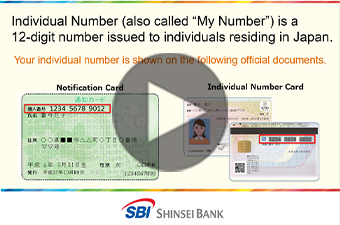

Introductory Help Videos & How-to Guide

The videos will be played on an external website (PIP-Maker).

Services at our branches are mainly provided in Japanese. Some branches have English speaking staff, but they may not always be available. If you have concerns about communication, we recommend visiting a branch with someone who can understand Japanese. We appreciate your understanding.

Some of our financial products are subject to risk, including possible loss of the principal amount invested. Before purchasing any of our financial products please ensure you carefully read and understand the relevant product description in Japanese. The product description provides details of the risks, fees, and charges etc. that each product entails.

If there is any discrepancy between Japanese and English, the Japanese takes precedence over the English.