PowerSmart Home Mortgage

A unique and distinct mortgage solution

Download Application

STEP4Send your application form to:

Housing Loan Credit Unit

SBI Shinsei Bank, Limited

Yorii Post Office P.O. Box 12

369-1290

Do you need an envelope? Please click here and download it.

Regarding PowerSmart Home Mortgage

- Loan term must be between 5 and 35 years (in units of 1 year). Loan amount must be 5 million yen or more and up to 300 million yen (in units of 100,000 yen).

- Upon termination of "floating interest rate (reviewed semi-annually)" or "floating interest rate (reviewed semi-annually) <Floating Focus>", floating interest rate will automatically apply.

- Upon termination of the initial fixed term, floating interest rate (reviewed semi-annually) will automatically apply.

- Customers may choose one of the Initial Fixed Interest Rates announced at the time of interest rate review. 5,500 yen (consumption tax inclusive) will be charged if selecting one of the fixed interest rate types.

- Interest rates are generally reviewed and determined each month by SBI Shinsei Bank, while there may be the case that SBI Shinsei Bank may review its rates within the month due to a change in market conditions. Please note that the customers are suggested to confirm the applied rate at the time of contract closing.

- Initial Fixed Interest Rates, Long-term Fixed Interest Rates and Step-down Long-tern Fixed Interest Rate may discontinue under extenuating circumstances due to interest rate fluctuations etc.

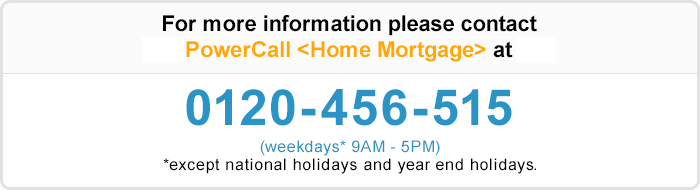

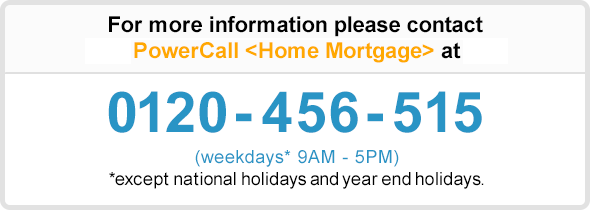

- For monthly repayment simulations for particular mortgage types, please visit our web simulation sites or contact PowerCall (Home Mortgage) at 0120-456-515, weekdays 9 a.m. - 5 p.m., except year-end/new year.

- Disbursement date of the loan may be decided by the customer. Please choose the date which comes before or on the last business day two months after the mortgage contract date.

- For Anshin Pack, the handling fee is 110,000 yen (consumption tax inclusive) and 55,000 yen (consumption tax inclusive) for customers who do not contract to Anshin Pack. For Floating Interest Rate (reviewed semi-annually) <Floating Focus>, the handling fee is 2.2% of total loan amount (consumption tax inclusive).In addition to the mortgage handling fee, other costs including collateral registration tax, stamp duty, scrivener fee, and the fire insurance premiums will be incurred.

- First lien with standard or revolving collateral will be registered against the property being financed by this mortgage until the mortgage obligation is fully paid.

- Product Description is available on SBI Shinsei Bank website.

- Customers may not refinance the current mortgage contracted with SBI Shinsei Bank.

- SBI Shinsei Bank will undertake a credit approval process and loan amount and tenor are subject to the final result which may not be the same as the original request.

- Please note that there are several conditions and requirements depending on the type of services and interest rates to be selected for the mortgage. For details please contact PowerCall (Home Mortgage).

[As of January4, 2023]

- Home

- Home Mortgage

- Download Application