GAICA Flex Prepaid Card

A Visa prepaid card you can use in Japan, online or in a store

How it works

Get a card

As long as your application is in order, it should take about a week after we receive your application for you to receive your card!

How to get a GAICA Flex Prepaid Card

STEP1

Login to PowerDirect

Input the 10-digit number embossed on your cash card

(3-digit branch number and 7-digit account number).

Input the 10-digit number embossed on your cash card

(3-digit branch number and 7-digit account number). Input your PowerDirect password.

Input your PowerDirect password. Tap "Login".

Tap "Login".

Move to "ATM�ECard" page and apply for the GAICA Flex Prepaid Card.

Click "Menu".

Click "Menu". Select "ATM�ECard".

Select "ATM�ECard".

STEP1

Login to PowerDirect

- ⑴ Input the branch code (3 digits) and account number (7 digits) shown on your cash card.

- ⑵ Input your PowerDirect Password.

- ⑶ Click Login.

- ⑷ Click the "ATM・Card" tab to move to "ATM・Card" page and apply for the GAICA Flex Prepaid Card.

- This is APLUS' website.

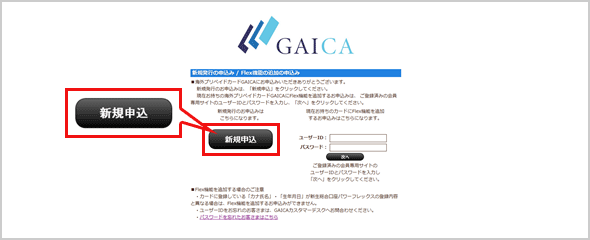

STEP2

Continue the process on the APLUS website.

Move to the APLUS website.

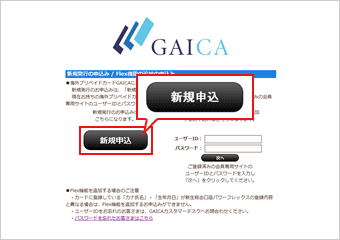

Click "新規申込" (New application) button on the left and follow the procedure. After completed, please click "登録" (register).

For more information about the new application, please check APLUS website.

STEP2

Continue the process on the APLUS website.

Move to the APLUS website.

Click "新規申込" (New application) button on the left and follow the procedure. After completed, please click "登録" (register).

For more information about the new application, please check APLUS website.

- This is APLUS' website.

STEP3

Receive an email from APLUS.

An email will be sent to the email address you registered in the APLUS application.

When you receive the email, please click the attached URL to continue the application. Once completed, please click "register".

STEP3

Receive an email from APLUS.

An email will be sent to the email address you registered in the APLUS application.

When you receive the email, please click the attached URL to continue the application. Once completed, please click "register".

STEP4

Application Complete!

Your GAICA Flex prepaid card will be sent to your home address.

STEP4

Application Complete!

Your GAICA Flex prepaid card will be sent to your home address.

- If you wish to use overseas ATMs, you need to register your individual number (My number) via the APLUS Member-Only Site after you receve your GAICA Flex Prepaid card.

As long as your application is in order, it should take about a week after we receive your application for you to receive your card!

How to get a GAICA Flex Prepaid Card

STEP1

Login to PowerDirect

Input the 10-digit number embossed on your cash card (3-digit branch number and 7-digit account number).

Input the 10-digit number embossed on your cash card (3-digit branch number and 7-digit account number). Input your PowerDirect password.

Input your PowerDirect password. Tap "Login".

Tap "Login".

Move to "ATM・Card" page and apply for the GAICA Flex Prepaid Card.

Click "Menu".

Click "Menu". Select "ATM・Card".

Select "ATM・Card".

STEP2

Continue the process on the APLUS website.

Move to the APLUS website.

Click "新規申込" (New application) button on the left and follow the procedure. After completed, please click "登録" (register).

For more information about the new application, please checkAPLUS website.

- This is APLUS' website.

STEP3

Receive an email from APLUS.

An email will be sent to the email address you registered in the APLUS application.

When you receive the email, please click the attached URL to continue the application. Once completed, please click "register".

STEP4

Application Complete!

Your GAICA Flex prepaid card will be sent to your home address.

- If you wish to use overseas ATMs, you need to register your individual number (My number) via the APLUS Member-Only Site after you receve your GAICA Flex Prepaid card.

Activate the card

To use your card, it must first be activated.

(Cards that have not yet been activated cannot be used.) Once you have received your card, please make sure you access the APLUS Member-Only Site and activate your card.

For more details on how to activate your card, please check APLUS website.

The APLUS Member-Only Site can be accessed here.

Load funds to your card

You can load your card from your SBI Shinsei Bank Yen deposit account or one of the 4 applicable foreign currency deposit accounts (US Dollar, Euro, Pound Sterling, Australian Dollar).

You will be able to load your card from the following 3 options;

Load: Load your account at your convenience.

Auto Reload: Balance is automatically loaded when the balance falls below the designated minimum balance registered by the customer (Japanese Yen only).*1

Monthly Auto Reload: Load your account monthly with a set amount on a designated day (Japanese Yen only).*1

Loaded foreign currency can be used only in areas where it is the local currency.

For more details on how to load your card, please check APLUS website.

*1 The reload amount will be removed from your SBI Shinsei Bank PowerFlex account.

- Loading your card with Yen is free of charge. A fee of 3.5% applies when loading foreign

currency.

For more details on fees, please click here.

Use the card to make purchases in Japan/overseas

Using in a store

The GAICA Flex can be used just like credit card in Visa affiliated stores in Japan and overseas.

Contactless payments can be made in stores that offer payments via Visa payWave.

For more details on how to use, please check APLUS website.

- You may be asked for your signature when making payments. Please ensure you sign the back of the card before making payments.

Using online

The GAICA Flex can be used in Visa participating online stores in Japan and overseas.

- Please enter the card user's name as "GAICA MEMBER" as shown on the front of the card.

- Please enter the expiry date shown on the front of the card.

Withdraw funds overseas - Register your Individual number (My number) -

Withdrawing funds overseas

Cash withdrawals can be made from ATMs overseas free of charge.*1

For more details, please check APLUS website.

- *1Depending on the overseas financial institution providing the ATM service, an extra fee from that institution may apply. Cash withdrawals cannot be made from within Japan.

- When withdrawing cash from an ATM overseas, any balance you have in that local currency will

be withdrawn.

If you do not have sufficient balance in that currency, funds will automatically be exchanged and withdrawn from any Japanese Yen balance you have loaded to your GAICA Flex. - Loading Japanese Yen to your GAICA Flex is free of charge. A fee will apply when charging foreign currency to your GAICA Flex.

Registering your Individual number (My number)

You are able to register your individual number after receiving your GAICA Flex prepaid card.

To register your Individual number (My number), please access the APLUS Member-Only Site. Please prepare your required documents and upload it/them.

For more details on how to register your Individual number (My number), please check APLUS website.

The APLUS Member-Only Site can be accessed here.

Reload your card or refund the fund to your account

If your loaded card balance runs out, simply reload it with more cash via APLUS Member-Only Site.

If you have any remaining balance on your card that you don't plan to use, simply send it back to your PowerFlex account free of charge!

For more details on how to load your card, please check APLUS website.

For more details on how to refund your funds to your account, please check APLUS website.

Tips and Support

GAICA Prepaid Card

- GAICA Prepaid Card (hereinafter the "Card") is the services which APLUS Co., Ltd. (hereinafter "APLUS") provides, and is not a product of SBI Shinsei Bank, Limited (hereinafter the "Bank").

- The Card is not a product provided for remittances carried out by banks, etc. including the Bank.

- The Card does not constitute the acceptance of deposits, savings, or installment savings. (You can't load cash directly.)

- The Card is not subject to the payment of insurance prescribed in the Deposit Insurance Act or in the Agricultural and Fishery Cooperation Savings Insurance Act.

- A system of security deposits for providing the services with the Card (hereinafter "Security Deposits") is established under the Payment Services Act in order to ensure the protection of the Members*. *The term "Member" shall refer to the person whom APLUS provides with the Card and authorizes to use the Card. APLUS makes a Security Deposit as follows for the issuance of the Card.

- Method of a statutory deposit: Money

- Official depository: the Osaka Legal Affairs Bureau - The Members shall have the right to receive payments with regard to the amount of the remaining balance on the Card for the return of Security Deposit in the procedures related to the execution of the right under the Payment Service Act.

- After issuing the Card, all transactions effected through the use of the Card are handled only by APLUS, and the Bank shall not take any responsibility whatsoever. Regarding transactions with the Card and the important information such as fee schedule of the Card, visit the APLUS website. For inquiries or questions, please contact APLUS.

Regarding foreign currency deposits

- As the conversion rates of foreign currencies into yen (foreign exchange rates) fluctuate, foreign exchange deposits carry a risk of loss of yen denominated principal resulting from exchange rate fluctuations when converting foreign currencies back into yen.

- In the event of high market volatility, system malfunctions, etc., the foreign exchange rates applied by the Bank may differ significantly from prevailing market rates. Customers are urged to confirm the foreign exchange rates to be applied to any such transactions.

- Foreign exchange fees apply when depositing/withdrawing yen into/out of foreign currency accounts. Unconventional currency exchange fees may be applied in the event of drastic foreign exchange rate fluctuations or when major markets are closed. The maximum rates of such one-way exchange fees and round-turn exchange fees are 5.5 yen per unit and 11 yen per unit respectively. For a direct non-yen cross currency exchange, the foreign exchange fees will be 0.02 multiplied by one of the currencies.

- There is a risk of loss of yen denominated principal due to the application of foreign currency exchange fees and applied interest rates, even if foreign exchange rates do not fluctuate.

- Preferred rates of Step Up program are applied to transactions changing yen to a foreign currency and vice versa. (n.b. Preferred rates are not applicable to transactions between non yen foreign currencies or when the outstanding foreign currencies balance is converted to yen as part of closing an account. Additionally, preferred rates are not applicable in exchanging currencies or paying interest in the PowerSupport Plus program, or purchasing foreign currencies through the PowerBuilder program.)

- Foreign currency deposits are not guaranteed by deposit insurance.

- In principle, foreign currency denominated time deposits may not be cancelled before maturity. However, in the event the Bank recognizes extraordinary circumstances and deems the cancellation of foreign currency denominated time deposits before maturity as unavoidable, only principal amounts will be refunded (interest thereon will not be honored).

- Interest is subject to 20.315% withholding tax (national tax 15.315% and local tax 5%). The fractional figure of the after-tax interest rate shall be rounded down.

- Principal and interest of foreign currency time deposits shall be credited into PowerFlex savings deposits of the same currency on the maturity date without converting into another currency. The savings deposit interest rate for the same currency will be applied on and after the maturity date.

- Cash in foreign currencies and foreign currency remittances are not available at our branches.

- Fees will be charged for foreign currency remittances.

- Handling Fee will be charged for incoming foreign exchange remittances.

- Application to GoRemit overseas remittance service must be made before making foreign currency remittances.

- Before investing in foreign currency deposits customers should carefully read the product description of foreign currency deposits (pre-contract document) that is available in the Bank branches and online so that they can fully understand characteristics of the foreign currency deposits.

- Home

- GAICA Flex Prepaid Card

- How it works