SBI Shinsei Bank Group aims to play a role as addressing environmental and social issues through financial solutions that facilitate the circulation of sustainable social capital. We have actively financed projects and companies that could contribute to resolving environmental and social issues through such means as project finance for renewable energy, financing senior care and medical service facilities and impact investment by Shinsei Corporate Investment Limited.

We established the Sustainable Impact Development Division in February 2020 in the Institutional Business of SBI Shinsei Bank aiming to contribute to build a sustainable society through finance to projects and enterprises with "Sustainable Impact", under the concept that integrates sustainability and ESG/SDGs with active and positive social impact.

In December 2022, we received the "Excellence Award" at the 8th "Sustainable Finance Awards" hosted by the Research Institute for Environmental Finance.

Receive the "Excellence Award" at the 8th "Sustainable Finance Awards"

About Sustainable Finance/Impact Finance

In order to support our clients' sustainability initiatives, SBI Shinsei Bank has prepared sustainable finance products that emphasize the consistency with the relevant Principles such as the Green Bond Principles and Social Bond Principles by ICMA (International Capital Market Association), the Green Loan Principles and the Sustainability Linked Loan Principles by Loan Market Association (LMA), etc., in addition to financing products with the sustainability assessment criteria we created, centered on the concept of "agreement and engagement" with borrowers. Below logos are granted according to the nature of our assessment.

| Green | Social | Overall sustainability | |

|---|---|---|---|

| Place emphasis on the consistency with principles such as the Green/Social Bond Principles |

|

|

|

| Assess based on the criteria created by SBI SHINSEI, centered on "agreement and engagement" |

|

|

|

*Sustainable Impact logos symbolize the vision of our Sustainable Impact businesses. The white magnolia, which blossoms towards the future from the cube as a symbol of solid credibility (SBI Shinsei Bank), expresses the spirit of sincere and fair Sustainable Impact businesses with its language of flower "dignity", "purity", "nobility", "perseverance", "love of nature".

Shinsei Green/Social/Sustainability Loan (Finance)

Shinsei Green/Social/Sustainability Loan (Finance) is a finance which designates the use of proceeds for businesses that contribute to solving or alleviating environmental and/or social issues. Shinsei Green Loans are used when you allocate the entire funds for financing projects with environmental benefits. Shinsei Social Loans can be used when the borrower allocates the entire funds for projects that aim to handle or alleviate social issues or contribute to the Sustainable Development Goals (SDGs). Shinse Sustainability Loans can be used when the loan proceeds are allocated to both green and social projects.

SHINSEI Sustainability Linked Loan

Sustainability Linked Loans support borrowers' sustainability management by setting ambitious and meaningful Sustainability Performance Targets (SPTs) and linking the finance terms and conditions such as interest rates to the achievement status. Unlike Green Loans or Social Loans, the use of loan proceeds are not limited therefore the proceeds can be used for general corporate purpose.

Positive Impact Finance

Positive impact financing is intended to generate a positive impact in at least one of the three dimensions of environmental, social, and economic performance, provided that significant negative impacts in any of the three dimensions are appropriately mitigated and managed. Positive impact financing involves a comprehensive impact analysis of the customers' business as a whole, identifying and evaluating impact topics of particular relevance. We confirm the impact creation over the term of the financing and support our customers' impact management efforts. Unlike green loans, the use of loan proceeds does not need to be restricted and can be used for the general corporate needs other than specific projects.

Climate Transition Finance

Climate Transition Finance is a financial method that aims to support companies that are considering measures to address climate change risks, and that are implementing initiatives to reduce greenhouse gas emissions in accordance with their long-term strategies toward the achievement of a decarbonized society. When procuring funds, we comprehensively evaluate the customer's "transition strategy" for decarbonization and the reliability and transparency of implementing the strategy, in addition to the projects / business activities where loan proceeds are used. Climate Transition Finance requires that the procurement process meet the elements of existing sustainable finance principles, such as the Green Loan Principles and the Sustainability Linked Loan Principles.

Sustainable Impact Capital Loan

Sustainable Impact Capital Loans enhance borrowers' capital strength as well as supporting their sustainability transition by providing long-term capital loans while engaging with borrowers on their ESG/SDGs initiatives.

This loan is subject to "Agreement & Engagement", and the borrowers will be required to agree with SBI SHINSEI on its sustainability transition targets and/or action plans and commit to have the regular engagement dialogue with us on its progress.

* Capital Loan is a loan product type whose terms and conditions have sufficient capital properties. When a Japanese financial institution evaluates the borrower's financial condition, Capital Loan can be treated as capital rather than as a liability.

General Process

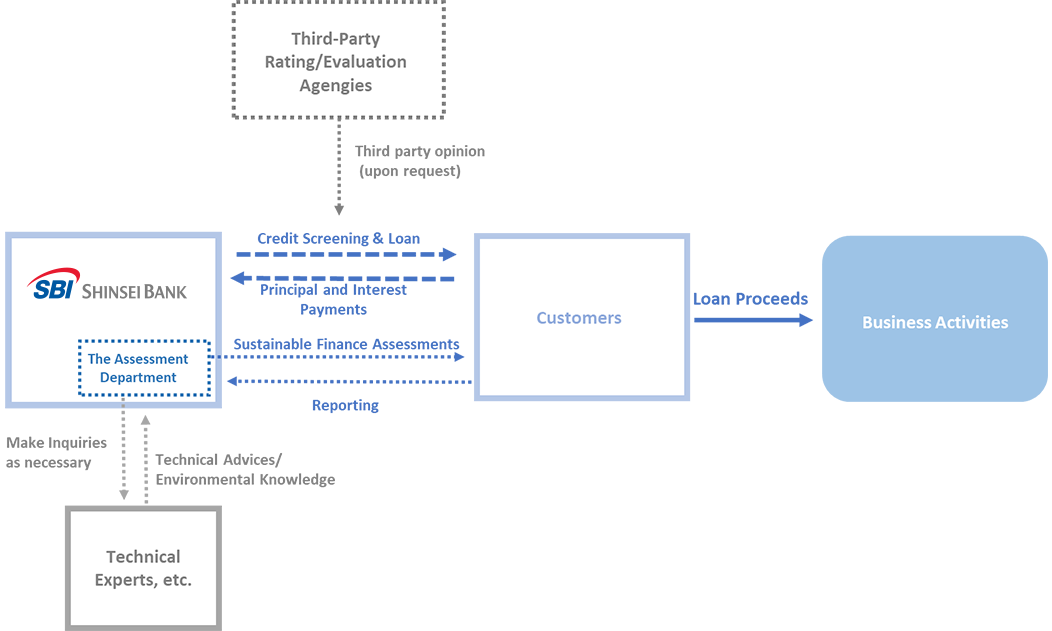

In addition to the normal credit screening process, a specialized team, the Sustainable Impact Assessment Department, assesses each sustainable finance in accordance with the prescribed sustainability requirements. The Department is independent of the sales-related divisions, and the team could conduct assessment with the advice of external experts in the environmental field, etc., when necessary such time as a further technical analysis is required.

*For loan products that emphasize consistency with relevant principles commonly accepted in the capital market, such as Green Bond Principles or Social Bond Principles, we can support you to obtain a third-party opinion from an external rating/evaluation agency upon request. The fees for external agencies will be charged separately.

Disclaimer

All products are subject to our prescribed conditions and credit screening process. Please note that depending on the results of the screening process, we may not be able to meet your request.

Products and Services

- Corporate Loans

- Loan Syndication

- Loan Arrangement

- Finance for Start-up

- Real Estate Non-Recourse Finance

- Project Finance

- Renewable Energy Finance

- Acquisition Finance

- Ship Finance

- Healthcare Finance

- Sustainable Finance/Impact Finance

Solutions